September marks the start of the busiest time of the year for Australian wagering. It is not only the beginning of spring racing season but it is also finals season for two of the biggest football codes: AFL and NRL. This year, the biggest players in wagering are hoping the odds are in their favour after issuing underwhelming financial results.

But even though there will be more eyeballs on sport and more bets placed than any other time of the year, the gambling companies aren’t guaranteed to make enough money to make up for the shortfall in profits caused by the cost of living crunch, higher taxes and stricter regulation.

The wagering sector remains under pressure due to higher taxes, regulation and cost of living pressures.Credit: Getty Images

While media companies and sporting bodies bemoan the expected loss of hundreds of millions of dollars in gambling advertising due to a mooted government crackdown, the financial position of the wagering companies themselves raises doubts about whether they’ll be able to maintain their ad spending.

Australians still lose more money on gambling than any other country in the world on a per capita basis, but the bulk of these losses are on poker machines housed in our pubs, clubs and casinos and not on sports betting. The country collectively lost $24 billion on gambling in 2021-2022, with more than half of this amount spent on the pokies and about a quarter on sports and racing bets.

The profits of Australia’s three betting giants – Tabcorp, Sportsbet and Ladbrokes – have fallen since COVID-19 due to the increased cost of living, higher taxes and regulatory changes including the ban on credit card deposits. In some ways, making less money is good news for the sector amid an ongoing political debate about stricter regulation. However, wagering executives are focused on maintaining the confidence of investors while also desperately trying to avoid inciting further public outrage and policy crackdowns.

The sector spent 30 per cent less on gambling ads this year, according to the latest data from advertising monitoring platform Neilsen, which showed wagering spend fell to $217 million in 2024 from almost $300 million last year and $310 million in 2022. Half of this amount is spent with commercial television networks, the biggest benefactor of gambling advertising. The second most used medium – and the fastest growing– is digital advertising on online platforms such as YouTube, TikTok and Instagram.

Australia used to be the cash cow of two of the world’s biggest players, Flutter and Entain, due to years of strong returns. Now, they’ve pivoted their focus to emerging gambling markets with less regulation such as the US, and they are less eager to invest down under, particularly in marketing.

Sportsbet controls 45 per cent of the wagering market in Australia but it is the only part of Irish giant Flutter’s portfolio that is consistently making less money every quarter. Flutter’s annual results won’t be released until December, but its 2023 report shows Sportsbet contributed just 12 per cent of the group’s $US12 billion revenue, and has been steadily declining for the past three years. The company made a net loss of $US1.2 billion.

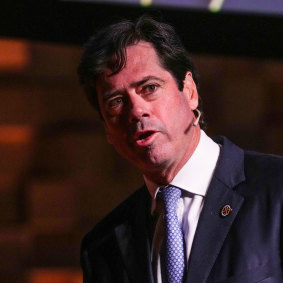

It’s no rosier for Australia’s other big player, Tabcorp, which remains predominantly reliant on retail betting, despite investing heavily in a digital-first strategy. New boss Gillon McLachlan, ex-chief of the AFL, recently unveiled a $1.36 billion loss for the 12 months to June 30 and issued a $1.3 billion write-down of the company’s assets, only six months after its last impairments. He also moved to overhaul the previous strategy, calling it unrealistic, and he is currently preparing his own.

Tabcorp chief executive Gillon McLachlan recently unveiled a $1.36 billion loss.

Macquarie cut its price target on Tabcorp by 50 per cent following McLachlan’s update. Macquarie analysts told clients the result was “disappointing” and that they were alarmed by the group’s operating costs, which were materially higher than expected.

Their note reads: “Tabcorp is in a challenging position, with Australian wagering volumes still finding a floor, and operating costs rising, which is materially impacting earnings. When the industry returns to growth, there will be high operating leverage, but ultimately the industry is competitive, and Tabcorp needs to win market share in digital, to mitigate structural decline within retail, to offset cost growth.“

Taylor Collison head analyst Andy Orbach called for more drastic measures and directed Tabcorp to buy another wagering business.

“Tab is not going to resonate with a 20-something-year-old sports punter. Ever,” his note read.

This is because not all wagering companies are in strife. Some smaller businesses including ASX-listed PointsBet are outperforming their bigger rivals after taking advantage of consolidation opportunities. Newer outfits tend to be less reliant on racing revenue and tend to be used by younger, sports-focused gamblers. Analysts have long called for more consolidation in the market and investors have encouraged the big players to take over their smaller competitors due to flexibility benefits that come from their often superior tech platforms.

PointsBet narrowed its losses to $40 million in the 2024 financial year, buoyed by the sale of its US operations and a 20 per cent reduction in its marketing spend. This may seem like a big loss at face value, but it’s more than a 50 per cent improvement on its $108 million loss in 2023. It’s pivoted from splashing more than $175 million in marketing in 2022 to just $71 million two years later.

Jarden analyst Rohan Gallagher earlier this year said PointsBet was well-placed to take market share from Ladbrokes and Sportsbet.

“With some of its major competitors either distracted (eg Entain head office issues), focused elsewhere … (for Flutter Entertainment’s Sportsbet), or have reduced local earnings following changes to [state] landscapes, we see a real opportunity for PBH and other domestic players (eg Tabcorp, BlueBet) to take share.

ASX-listed BlueBet recently completed its merger with Matt Tripp-backed Betr and promptly moved to announce the sale of its US business, mirroring PointsBet. BlueBet is aiming to grow to 10 per cent of the Australian market in the “short to medium term”, up from about 3 per cent.

Following the dismal financial performances from the main players in 2024, analysts seemed to have walked back the expectation the industry would return to profitability this financial year. This means the groups will be desperately looking for ways to cut costs and add value in the brave new world of higher taxes and increased scrutiny. Even if the government fails to enact its gambling advertising crackdown, it’s unlikely there’ll be much cash for the big bookies to splash on free-to-air TV ads shown to already outraged people who don’t bet on sport anyway.

The Business Briefing newsletter delivers major stories, exclusive coverage and expert opinion. Sign up to get it every weekday morning.