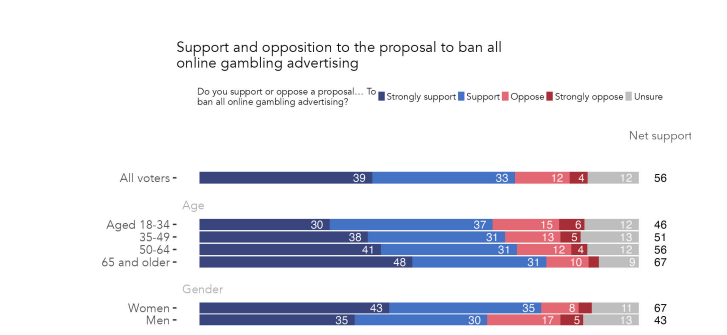

Only 46 per cent of Aussies aged between 18 and 34 support a total gambling advertising ban, according to a study conducted by insights and strategy business Redbridge Group.

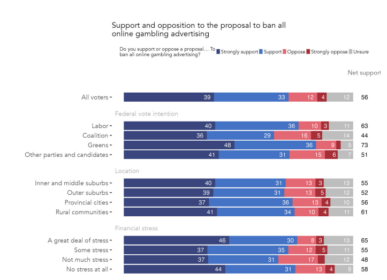

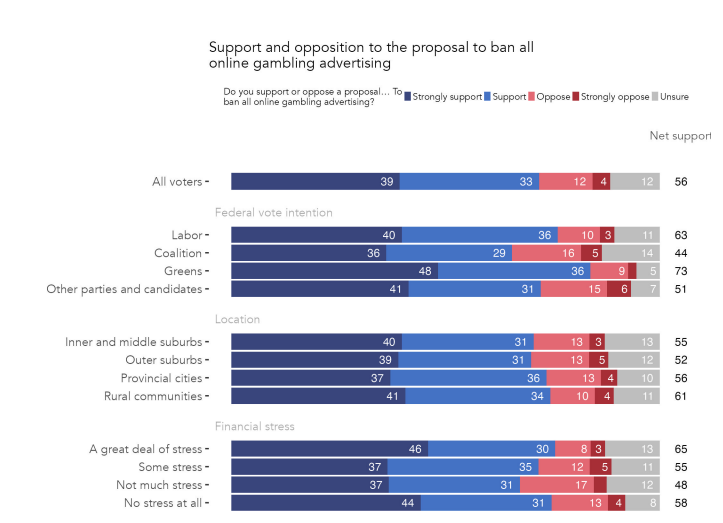

The research revealed that 72 per cent of Australians support the ban but revealed that support is the weakest among younger Australians and Liberal voters. It also revealed that only 43 per cent of men supported the ban as opposed to 67 per cent of women.

While support was weakest in the younger demographic, a massive 67 per cent of respondents aged 65 and above revealed that they would support the ban. The 50-64 demographic fell close behind with a net support of 56 per cent.

Support for the ban was strongest in regional communities and provincial cities and among Greens and Labor voters. Support was also far greater in lower-income households, with 66 per cent of households that earn less than $1000 per week supporting the ban.

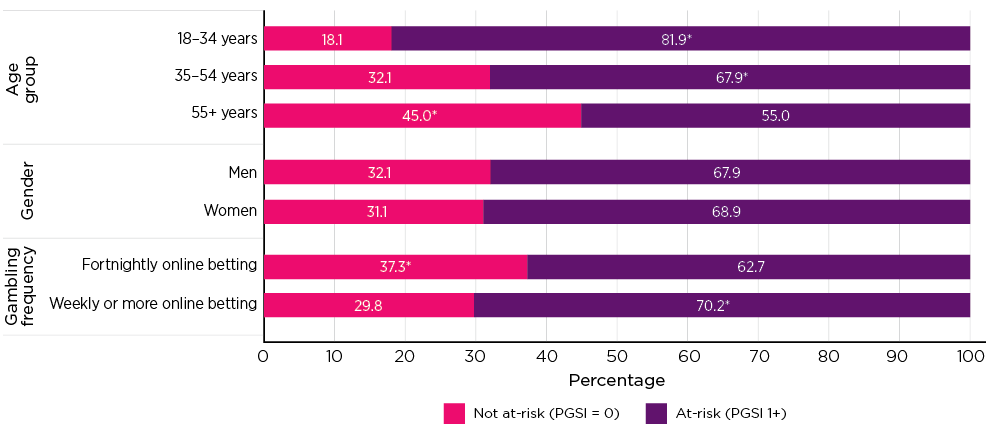

According to the Australian Institute Of Family Study’s National Gambling Trends Study published in October last year, adults aged between 18-34, the demographic most opposed to a total gambling ban, have high levels of at-risk gambling. There was a higher prevalence of at-risk gambling among younger regular online bettors (aged 18-34 years), with more than four in five of this age group classified as at-risk (81.9 per cent) compared to those aged 35-54 years (67.9 per cent) or 55+ years (55.0 per cent).

Among regular online bettors, participation in gambling activities was proportionately higher for those in younger age groups (18-34 and 35-54 years) than the oldest age group (55+ years), with the exception of horse race betting, keno and lotto/lottery games. Betting on sports among regular online gamblers was most prevalent in the younger age groups (96.2 per cent among those aged 18-34 years; 91.5 per cent among those aged 35-54 years) than the oldest age group (70.1 per cent among those aged 55+ years).

The study also revealed that median monthly expenditure on gambling activities was higher for men and the younger age group. Those in the 18-34 demographic, had an estimated expenditure (per month median) of $886 on gambling activities.

The Redbridge study comes at a time when the topic of gambling advertising is being hotly debated in parliament and across the country. With a decision set to be handed down in the coming weeks, B&T understands that a total ban is not off the table.

Social Services Minister Amanda Rishworth said she is still working through the 32 recommendations from the parliamentary inquiry into the danger of online gambling. In addition to the primary recommendation of phasing out all gambling ads over three years, the inquiry suggested a national strategy that would focus on reducing gambling harm and creating a dedicated regulator with responsibility for all licensing and regulation.

Last month, it was reported that the Albanese Government would not support a total ban as recommended by the enquiry but would instead propose caps of two gambling ads per hour until 10 p.m. and a ban on ads before and after live sports events from 2026. The changes would also include banning ads on digital platforms.

The proposal was widely criticised by several MPs and former politicians from all branches of the political spectrum and by a number of industry bodies.

Surprisingly, the proposed caps were also condemned by Tabcorp, which used its submission to the review to call for a reduction in the record level of gambling advertising, saying that it should be limited to places where people go to gamble, “including pubs, clubs, or racetracks or on exclusive platforms dedicated to gambling events such as Sky Racing TV and radio”.

“Foreign bookies have been targeting customers of pubs, clubs, and the local Australian state-based licensee with aggressive advertising and inducements, especially when retail venues were forced to close during the pandemic,” Tabcorp said in its submission.

Broadcasters, however, have warned that a stringent cap on gambling advertising could significantly impact their finances. The broadcasters have argued that a reduction in gambling ad revenue might force them to cut back on their $1.6 billion annual investment in news, sports, and local drama. It was previously estimated that a complete ban could result in a $240 million shortfall across television and radio.

B&T understands that media companies will be given several years to scale back their reliance on advertising revenue from gambling firms in a federal move to soften the impact of the changes – whatever they end up being.

Gambling ads during live sports are currently banned five minutes before and after play, between 5 a.m. and 8:30 p.m. After 8:30 p.m., these ads can appear before and after play and during breaks in play.

According to the Australian Communications and Media Authority, more than a million gambling ads appeared on free-to-air television, radio, and online from April 2022 to April 2023, costing a reported $238 million.

Studies suggest that 7 in 10 Australians believe there are too many betting advertisements and that gambling advertising on television should be banned, and parents, in particular, are concerned about their children’s vulnerability to gambling advertising. It is estimated that Australians lose over $25 billion each year to gambling, the highest per capita spend in the world.