svetikd

Executive Summary

I believe that Gambling.com’s (NASDAQ:GAMB) recent selloff is an overreaction, overlooking the company’s strong fundamentals and promising growth trajectory. GAMB, a growing player in digital marketing within the sports betting industry, has demonstrated strong financial performance, including very strong revenue growth in the last year. The online gambling industry, particularly in the U.S., presents expansive growth opportunities, which GAMB is well-positioned to capitalize on.

My valuation model, projecting a steady rise in revenue and EBITDA over the next five years and employing a 10x EBITDA exit multiple, suggests a target share price of $14.73. While mindful of regulatory, competitive, and operational risks, my analysis leads me to recommend GAMB as a buy, with its current market undervaluation presenting a favorable entry point.

Company Overview

Gambling.com Group Ltd., headquartered in St. Helier on the Channel Island of Jersey, provides marketing and related services to the online gambling industry. Established with the vision of creating a platform to guide gamblers to various online gambling websites, GAMB has developed into a fast-growing player in the digital marketing domain.

The company’s leadership is bolstered by co-founder and CEO Charles Gillespie, who brings extensive experience from the sports betting industry. GAMB’s core business model revolves around its primary offerings, which include:

- Referrals: By building a network of affiliate referral relationships, GAMB connects users to various online iGaming (full online casino) and sports betting sites and applications.

- Online Comparison Websites: These platforms are integral to GAMB’s strategy, enabling users to compare and choose among various gambling services.

GAMB operates notable sites such as Gambling.com and Bookies.com, among others. The revenue generation model of the company is versatile, incorporating a revenue share model and a cost-per-acquisition model, or a blend of both. This diversified approach allows GAMB to monetize its services effectively while catering to the dynamic needs of the online gambling market.

Recent Financial Performance

GAMB reported exceptional financial results (albeit disappointing based on investor expectations) for the third quarter, demonstrating robust growth and operational efficiency. The company’s revenue increased by 19% to a record $23.5 million for the quarter, driven predominantly by a 42% increase in North American revenue, which reached $12.9 million. This growth in North America is a testament to GAMB’s growing market presence and strategic expansion efforts in this region.

Key financial highlights from the quarter include:

- Net income rose significantly to $5 million, up from $2.26 million in the same period last year. This reflects a notable increase in profitability, with the net income margin expanding from 12% to 21%.

- Adjusted net income for the period attributable to shareholders was $5.41 million, although it marked a 10% decrease compared to the previous year.

- Free Cash Flow for the third quarter was reported at $1.58 million, contrasting with the negative cash flow from operating activities of $715,000. This underscores GAMB’s ability to maintain liquidity and financial flexibility as a growth story.

CEO Charles Gillespie highlighted the company’s consistent performance and organic growth in North America. He emphasized the 26% increase in new customers, surpassing 86,000, which significantly contributed to the revenue growth. Gillespie also pointed out the success of strategic media partnerships, particularly in the North American market, which has been complementing the growth of GAMB’s owned assets.

The quarter also saw several key business highlights, including the launch of Casinos.com and the commencement of the company’s first international media partnership with The Independent in the U.K., indicating strategic diversification and expansion.

Elias Mark, the Chief Financial Officer, commented on exceeding revenue expectations and alignment of Adjusted EBITDA with expectations, largely due to the rapid acceleration of North American media partnerships. The year-to-date revenue growth and disciplined capital efficiency resulted in a Free Cash Flow of $16.3 million for the first nine months of 2023, surpassing the full-year 2022 level. This positions the company well for delivering strong full-year results, with anticipated year-over-year revenue and Adjusted EBITDA growth of more than 30% and 50%, respectively.

Looking ahead, GAMB confirmed its full-year 2023 revenue guidance, expecting it to be between $100 million and $104 million, implying an organic revenue growth of 31%-36%. Adjusted EBITDA is projected to be between $36 million and $40 million. The company’s outlook does not anticipate revenue from any additional North American markets or new acquisitions for the remainder of 2023. It also highlights ongoing investments for the development of Casinos.com and support for its media partners, including Gannett, McClatchy, and The Independent.

Industry Overview

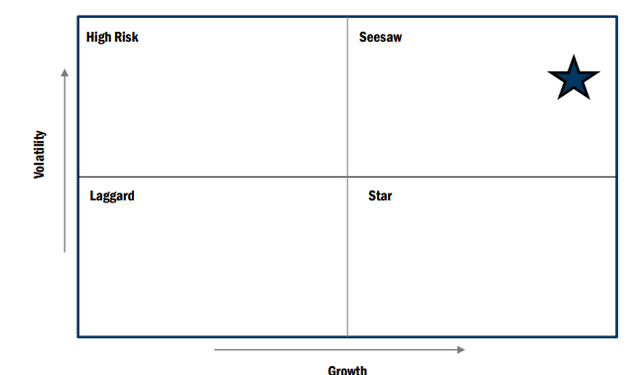

Value Voyage Industry Attractiveness Index

The online gambling services industry in the United States, where GAMB operates, has been undergoing significant transformations. This industry, historically limited by regulatory constraints, has seen a paradigm shift, particularly following the landmark 2018 Supreme Court decision. This ruling overturned the Professional and Amateur Sports Protection Act (PASPA), catalyzing a wave of state-by-state legalization of online gambling. The impact of this deregulation has been profound, not just in terms of legal compliance but also in opening up new market territories and customer segments for operators like GAMB.

From a growth perspective, the industry has been on an impressive upward trajectory. Between 2018 and 2023, the industry’s revenue is estimated to have grown at a compound annual growth rate (CAGR) of 36.0%, soaring to $4.8 billion, according to IBISWorld. This rapid growth, however, includes an anticipated contraction of 8.9% in 2023, a figure that might reflect market corrections or saturation in certain jurisdictions.

The regulatory landscape in the U.S. for online gambling services remains complex and varied. By of the end of 2021, online sports betting was legal in 23 states, with comprehensive online gambling being legal in seven states including Connecticut, Delaware, Michigan, New Jersey, Nevada, Pennsylvania, and West Virginia. This fragmented regulatory environment presents both challenges and opportunities for companies like GAMB. They must navigate a multitude of state laws and compliance requirements, tailoring their strategies to align with the legal frameworks of each jurisdiction.

Moving forward, the industry is poised for continued growth, albeit at a slightly moderated pace. Revenue is projected to increase at a CAGR of 13.0% from 2023 to 2028, potentially reaching around $8.8 billion. This growth is expected to be driven primarily by increasing consumer spending, as individuals become more inclined to allocate their disposable income to discretionary activities like online gambling. Additionally, the industry’s future expansion will be influenced by the number of new states that legalize online gambling, with several currently considering relevant legislation, as covered in the section below.

Rapidly Expanding Market

GAMB is strategically positioned to capitalize on rapidly expanding markets in the United States, as legislative developments continue to open up new opportunities in online gambling. The company’s focus on North America, already its largest market, is set to benefit significantly from these legislative changes. As of the Q3 2023 earnings call, 43 states have yet to legislate full online gambling (iGambling), and 20 states are still in the process of approving online sports betting. This scenario presents a substantial runway for growth for GAMB, particularly in the U.S. market. The anticipated launch of online sports betting in North Carolina in the first half of 2024 exemplifies this potential. Furthermore, the 2024 legislative season is expected to see initiatives for sports betting in states like Minnesota, Mississippi, and Missouri, and for iGaming in New York, Illinois, and Indiana, with a ballot initiative in Maryland expected in 2024. These developments indicate a significant expansion of the market landscape for GAMB.

The company’s management is optimistic about leveraging these legislative changes to enhance its market presence and drive growth. The success of GAMB’s media partnership strategy, particularly in states with new market openings, underscores its ability to capitalize on these opportunities. For instance, the strong performance in Kentucky following its recent sports betting launch serves as a testament to GAMB’s effective strategy and the scalability of its business model. The company’s leadership in new state launches, as evidenced by the feedback from partners in Kentucky, demonstrates GAMB’s competitive edge and readiness to maximize its market share in these evolving landscapes. With a focus on forging deep relationships with major news media players and optimizing the benefits of these partnerships, GAMB is well-positioned to sustain and expand its reach in these growing markets.

Valuation Overview

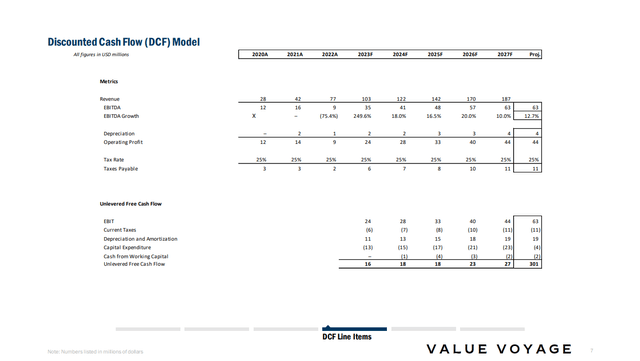

GAMB also demonstrates strong potential for growth and profitability, as evidenced by my discounted cash flow (DCF) analysis. This analysis conducted independently and then benchmarked against analyst expectations, ensures a comprehensive assessment of GAMB’s value.

Starting in 2023, GAMB is expected to generate revenue of $103 million, setting the stage for consistent growth in subsequent years. Revenue projections show an increase to $122 million in 2024, followed by a rise to $142 million in 2025. This upward trajectory is anticipated to continue, with revenues reaching $170 million in 2026 and $187 million in 2027. These projections reflect GAMB’s growing position in the online gambling services market and its ability to leverage the expanding demand within this sector.

DCF Line Items (Author’s Calculations)

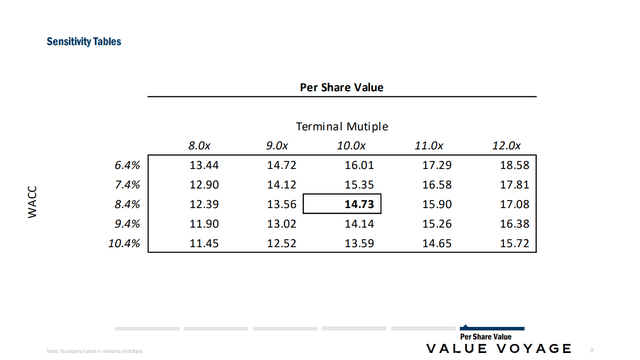

In terms of earnings before interest, taxes, depreciation, and amortization (EBITDA), GAMB is projected to achieve $35 million in 2023, with an expected increase to $41 million in 2024, and further growth to $48 million in 2025. By the end of the projection period in 2027, EBITDA is anticipated to reach $63 million. Applying a 10x EBITDA exit multiple, derived from trading history and comparable company analysis, I arrive at an enterprise value and a corresponding per-share value of $14.73. This valuation assumes a weighted average cost of capital (WACC) at a specific rate, as detailed in supporting documentation.

Per Share Value (Author’s Calculations)

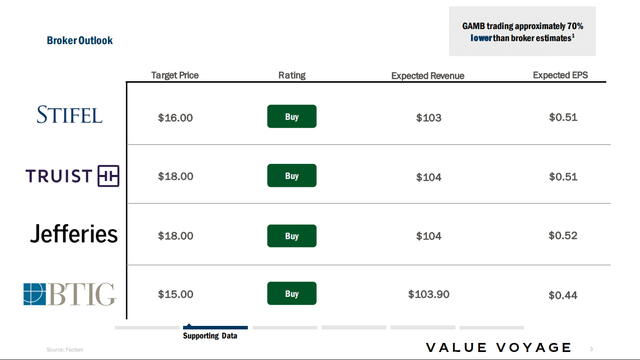

My target price falls slightly below current analyst expectations, which range from $15-$18 per share:

Broker Outlook (Accessed from FactSet)

The full range of my valuation sensitivity analysis, accounting for various exit multiples and costs of capital, yields a share price range from $13.44 to $15.72. This range reflects a strong potential upside for GAMB, positioning it as a compelling investment opportunity in the online gambling sector.

Risk Analysis

My thesis includes a couple of key risks. First, the regulatory landscape in the United States poses a significant challenge. The online gambling industry is marked by a fragmented and continuously evolving regulatory environment. Changes in legislation or enforcement at both federal and state levels could have adverse effects on GAMB’s operations, requiring agility and adaptability in their business strategy.

Another crucial factor is the intensity of market competition. As the online gambling sector grows, it attracts an increasing number of service providers, leading to potential market saturation. This scenario could impact GAMB’s profit margins and market share, making continuous innovation and effective marketing strategies essential for maintaining competitiveness. The industry’s reliance on discretionary consumer spending also makes it vulnerable to economic fluctuations and shifts in consumer behavior. Economic downturns or changes in leisure preferences could lead to a decrease in demand for GAMB’s services.

Finally, operational and technological risks are inherent in GAMB’s business model. As a digital platform, ensuring robust cybersecurity measures and maintaining technological competitiveness is paramount. Any significant breach or failure in their IT systems could lead to reputational damage, loss of customers, and potential legal liabilities. These risks, from regulatory challenges and competitive pressures to economic dependencies and operational necessities, are critical considerations in evaluating GAMB’s growth prospects and financial stability.

Conclusion

In concluding my analysis of GAMB, I recognize the company as a compelling investment opportunity, thanks to its robust financial performance and strategic position in the rapidly growing online gambling industry. GAMB’s market positioning within the digital marketing for the sports betting sector is marked by impressive revenue growth, particularly in North America. The U.S. online gambling market, in particular, is evolving rapidly, driven by legislative changes and a surge in consumer adoption of digital gambling platforms. GAMB’s effective navigation of this landscape, demonstrated by its successful expansion in newly legalized states and a targeted approach to emerging market segments, underscores its potential for continued growth.

My valuation model supports this optimistic outlook, projecting a steady rise in revenue and EBITDA over the next five years, culminating in a target share price that provides significant upside. While I acknowledge the risks inherent in the regulatory environment, market competition, and operational challenges, GAMB’s strategic initiatives and operational resilience appear to effectively mitigate these concerns. The company’s agility in adapting to regulatory shifts, its commitment to innovation and strategic partnerships, and its sound financial management collectively reinforce its strong continued presence. Therefore, my recommendation for GAMB is a Buy. The current undervaluation in the market, juxtaposed with GAMB’s strong fundamentals and growth prospects, presents an attractive entry point for investors.