Cryptocurrency trading should be regulated as a form of gambling rather than a normal financial service, MPs have said.

Products such as bitcoin “have no intrinsic value and serve no useful social purpose” while consuming large amounts of energy and being used by criminals, according to a report by the Treasury Select Committee.

They are frequently called currencies, despite not being backed by anything of real value. Two of the best known, bitcoin and ether, account for two-thirds of all cryptoassets.

The report warns that they pose significant financial risks to consumers, given their price volatility and the loss risk.

They say they fear that if crytocurrency deals as a financial service are permitted it will create “a ‘halo’ effect that leads consumers to believe that this activity is safer than it is, or protected when it is not.”

A previous report by the committee likened cryptocurrency markets to the lawless wild west. The report estimates the current total cryptoasset market to be worth $1.2trn (£958bn) or 0.2 per cent of the $487trn (£424trn) of total global financial assets, down from a $2.9trn (£2.3trn) peak in November 2021.

MPs argue that as retail trading in crypto resembles gambling rather than a conventional financial service, the Government should regulate them accordingly.

The “most convincing use case” MPs heard for the crypto industry was that the innovative technologies it uses have the potential to bring “efficiency benefits to financial services and the wider economy”.

MPs criticised Treasury plans to get the Royal Mint to produce a cryptoasset in the form of a UK non-fungible token (NFT) – a plan since abandoned.

The Committee is considering central bank digital currencies, a subject currently being looked at by the Bank of England, separately from the wider cryptoasset market.

Ministers need to take a “balanced approach to supporting the development of cryptoasset technologies, and avoid expending public resources on supporting cryptoasset activities without a clear, beneficial use case”, the report warns.

When he was chancellor, Prime Minister Rishi Sunak said it was his ambition to “make the UK a global hub for cryptoasset technology”, calling it “the businesses of tomorrow”.

The Government proposes to regulate the crypto industry and will give the watchdog Financial Conduct Authority greater powers to regulate it via the Financial Services and Markets Bill currently being debated in Parliament.

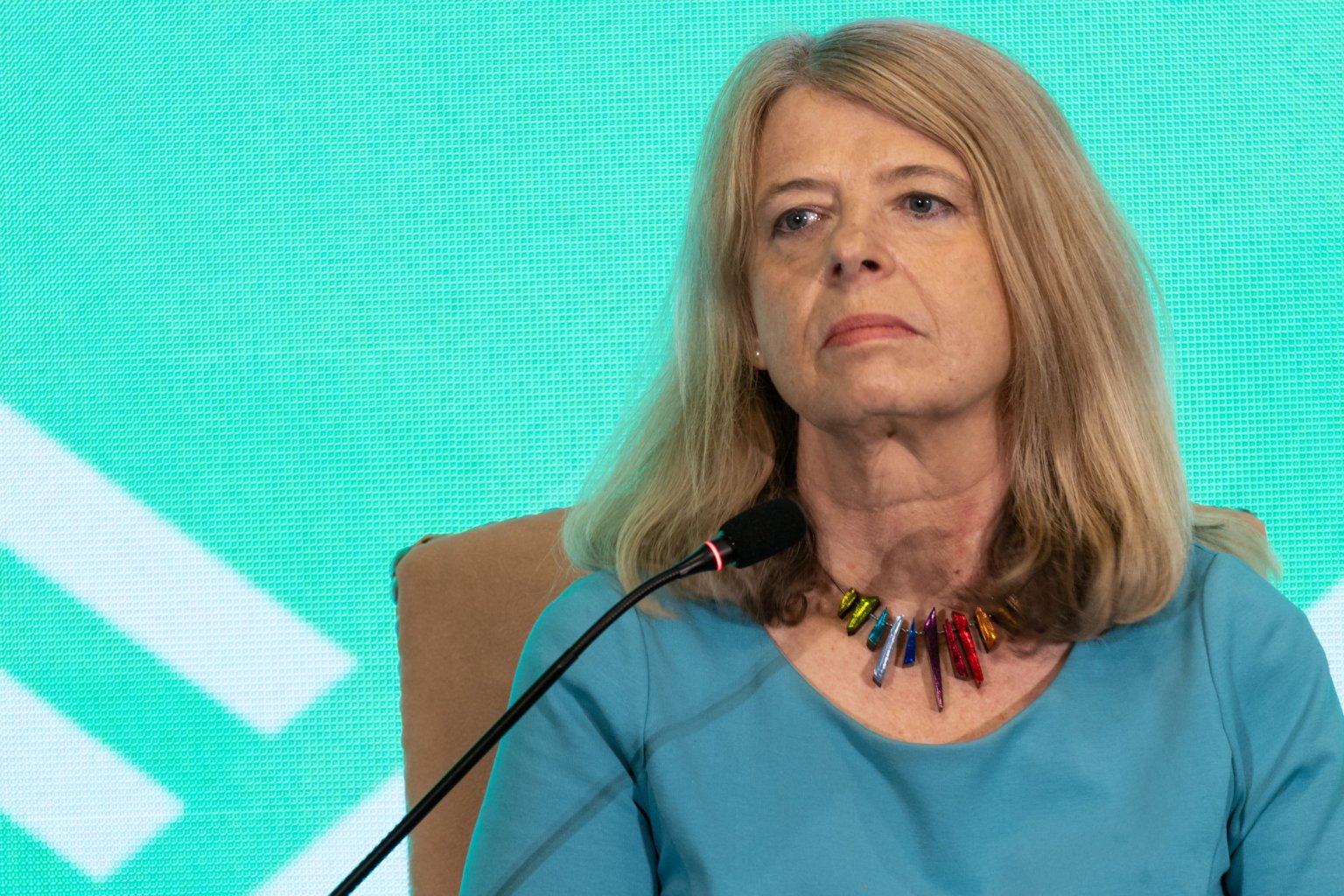

Harriett Baldwin MP, the Treasury committee chair, said: “The events of 2022 have highlighted the risks posed to consumers by the cryptoasset industry, large parts of which remain a wild west. Effective regulation is clearly needed to protect consumers from harm, as well as to support productive innovation.

“With no intrinsic value, huge price volatility and no discernible social good, consumer trading of cryptocurrencies like bitcoin more closely resembles gambling than a financial service, and should be regulated as such. By betting on these unbacked ‘tokens’, consumers should be aware that all their money could be lost.”

A Treasury spokesperson said: “Risks posed by crypto are typical of those that exist in traditional financial services and it’s financial services regulation – rather than gambling regulation – that has the track record in mitigating them.

“Crypto offers opportunities but we are taking an agile approach to robustly regulating the market, addressing the most pressing risks first in a way that promotes innovation.”

An FCA spokeswoman said they welcomed the MPs report. It said it was working closely with government on any future regulatory regime but added: “People should be aware that engaging with cryptoassets remains high risk. If you purchase crypto, you should be prepared to lose your money – if you purchase crypto there is unlikely to be any protection if something goes wrong.”