The total value of all 32 NFL teams is about $141 billion.

The combined gross domestic product of Montana, Wyoming and both Dakotas is $196 billion. Americans spent about $150 billion last year on cable TV, internet service and movie theater tickets. This year’s Department of Homeland Security budget is $183.3 billion.

None of that holds a candle to the whopping value of the legal US gambling industry.

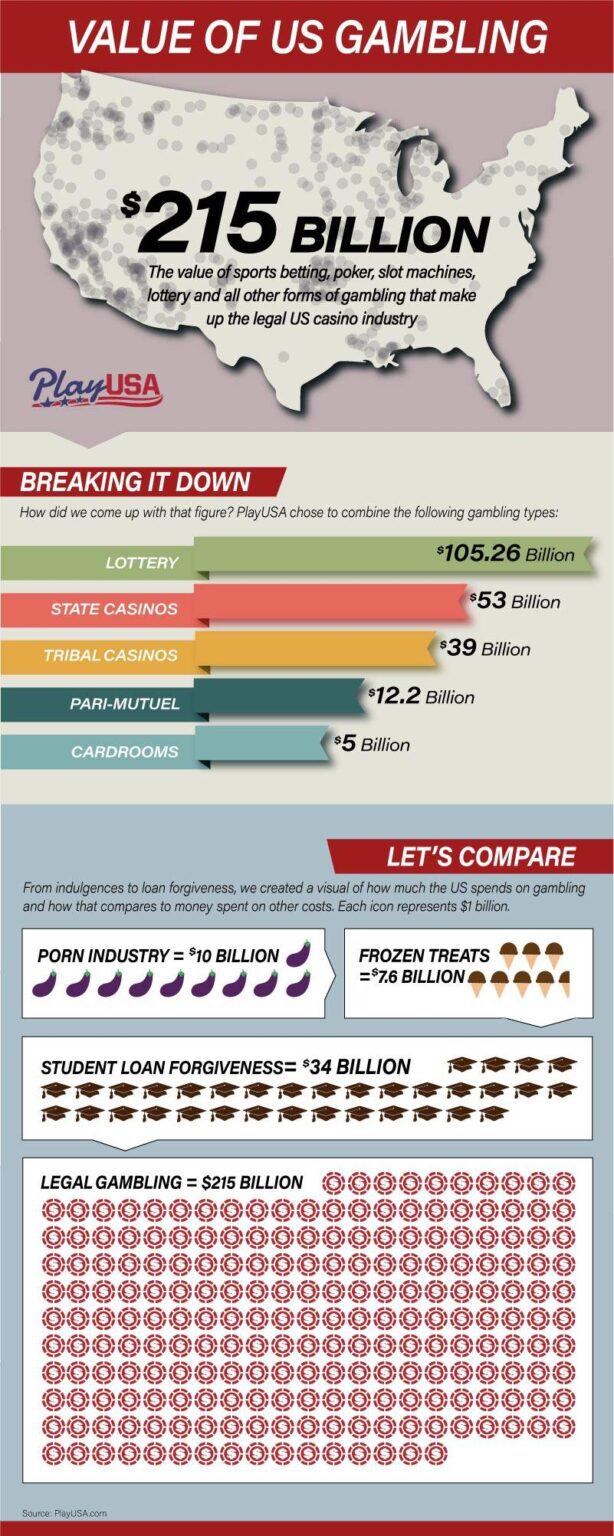

That number? More than $215 billion, according to the results of a monthlong examination of state and local records. PlayUSA aimed to put a number on the value of the legal industries of games of chance and skill in 2021.

That includes all forms of gambling, from sports betting and online poker to slot machines and lotteries.

This may be the best available data — and it’s a strikingly huge number. However, it’s also certainly a low-ball figure that overlooks gambling-themed charity activities, revenue for illegal offshore casino websites, play in nearby international waters on cruise ships, March Madness brackets and more.

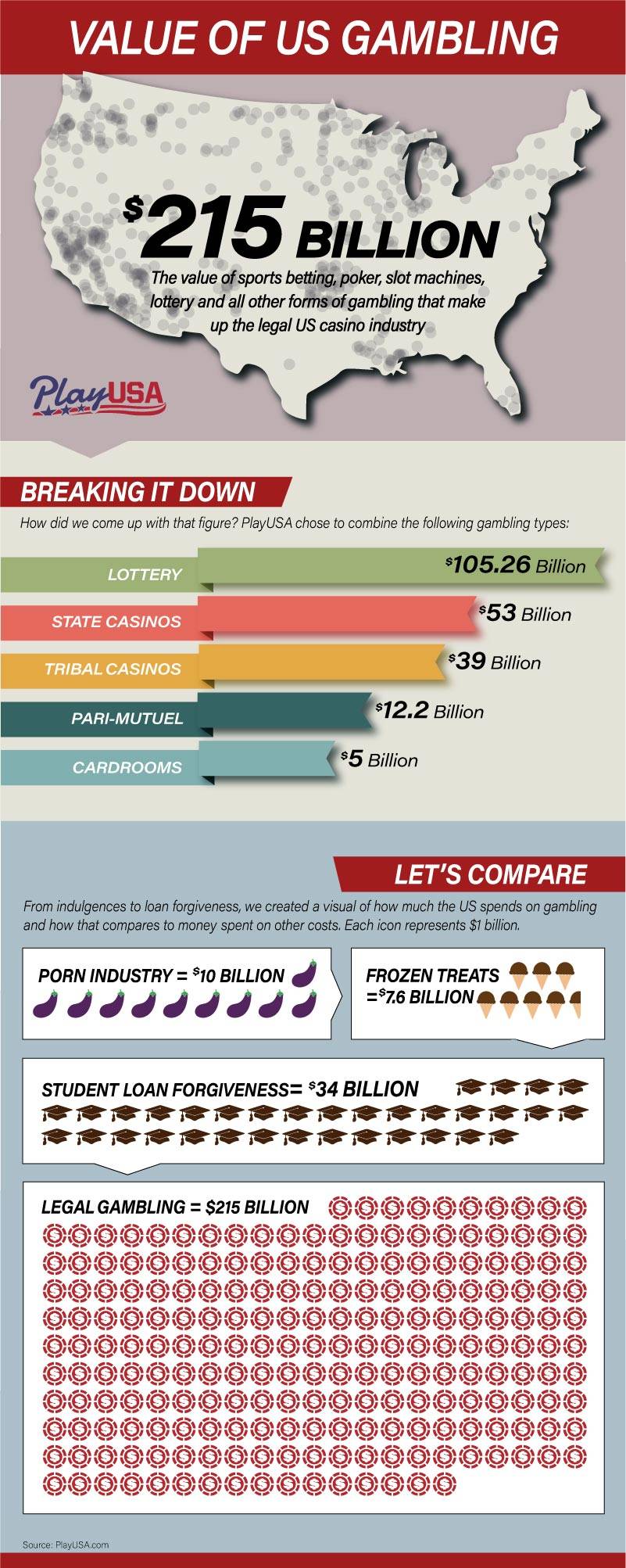

Still, at $215 billion, that’s more than double the combined cost of all US foreign aid ($51 billion), President Joe Biden’s student debt forgiveness plan ($34 billion), the value of the US porn industry ($10 billion) and a year’s worth of all the ice cream and sherbet sold in America ($7.6 billion).

You get the idea; it’s a lot.

Gambling is forever as American as apple pie

As online gambling continues to expand into new states — among other ways the casino business evolves — the number is guaranteed to keep ballooning, said Alan Feldman, a distinguished fellow. He focuses on responsible gambling at the University of Nevada Las Vegas’ International Gaming Institute.

Feldman said that Americans have enjoyed playing games of chance since the British colonists gambled to pass the time on the ships crossing the Atlantic Ocean to the New World.

In 1863, in fact, Harper’s Weekly ran a story about Civil War soldiers passing time that included: “Some inveterate players, belonging to the Ninety-third New York, were provided with a table, dice and a tin cup for a dice box and, under charge of a guard, were kept at their favorite amusement all day, playing for beans, with boards slung on their shoulders with the word GAMBLER written on them.”

That as a legal, regulated industry, gambling would blossom into such a massive economic powerhouse in the US was pre-ordained, Feldman said.

“These numbers sound right, and they do not surprise me, in part, because the gambling industry, led by the casino and tribal casinos, have come to realize that this is a lot of fun if you give people a reason to come and a reason to stay and relax and enjoy themselves.

Feldman, previously the longtime spokesperson for MGM Resorts and its prior incarnations, “This can be – in point of fact, should be – a very healthy, fun activity.”

PlayUSA Casino lead analyst Eric Ramsey admitted being startled about where the industry fits in the context of other businesses and endeavors. Ramsey said:

“It’s a little jarring for me to hear those numbers even though I stare at gambling numbers.

“I’m sitting here looking at sports betting revenue, where last year, it was about $4 billion. That seems like an enormous number to me. Those are numbers we’ve never seen before in this industry in this country. And then you’re throwing out numbers like $200 billion for the larger gambling industry. To have the context that it’s more than all the football franchises, I never thought about that scale.”

$215 billion in legal gambling, broken down

The task of deciding how to define “value” and what to include in elements of the “legal gambling industry” was vexing. The industry generates a lot of data for public consumption, much of it of little use, of unknown origin or unverifiable to journalists or analysts.

PlayUSA chose to combine the following metrics to derive its figure:

- $105.26 billion: Total sales of lottery tickets for state and national games in 2021, accumulated from reports to state authorities.

- $53 billion: Total gross gaming revenue for 2021 at the nation’s 466 “commercial” casinos (non-tribal). This figure, provided by the American Gaming Association, is verifiable because the casinos are required by law to provide data to their state’s gaming control commission. This includes legal online gambling, which also is reported to the state regardless of whether a tribal partner is involved.

- $39 billion: Total gross gaming revenue for 2021 at the country’s 510 tribal “gaming operations,” aka casinos. This figure, provided by the National Indian Gaming Commission, is “calculated from the independently audited financial statements” of the casinos owned by 243 tribes operating in 29 states, according to the organization.

- $5 billion: Total wagering last year at California cardrooms, a figure reported to the state by the California Gaming Association that is not included in commercial or tribal gaming data.

- $12.2 billion: Total amount wagered in legal pari-mutuel betting in 2021, according to Equibase, North America racing’s official database. That figure accounts for betting on 33,567 races, Equibase said.

The PlayUSA approach vs. others

There are many other ways to quantify the industry’s value. For instance, the sum total of the market capitalization of the 15 biggest publicly traded casino-related companies based in the US as of the end of August 2022 was $79.14 billion.

However, that includes companies such as Las Vegas Sands ($27.7 billion) and Wynn Resorts ($6.66 billion), which do a significant portion of their business overseas. It excludes overseas companies such as Evolution Gaming ($16.2 billion) and Flutter Entertainment ($21.8 billion) with American subsidiaries and assets.

The AGA has its own measure, but there are problems with that, too.

Every year since 2018 – despite a wild fluctuation in market conditions thanks to the COVID-19 pandemic – the casino industry’s lobbying arm has stated in its annual reports that the sector “contributes $261 billion to the US economy.” The origin and composition of that figure, however, are unclear, and the notion that it hasn’t changed year after year is a reminder of how difficult it is to draw such conclusions.

Nonetheless, the figures compiled by PlayUSA feel accurate to scholars such as Feldman. It’s also useful, he said, to examine and compile these figures for various reasons.

“From a sociology perspective, you do it to understand how people are spending their money and what activities they prize.

“… And then, when you add it altogether, I think it’s important to be able to articulate to policymakers and, in some cases, community leaders and the media, that we should not ignore the fact that this kind of entertainment is wildly popular and worth potentially more than some of the entertainment industries we’ve always assumed were huge.”

Drawing in the lotteries

Perhaps the most intriguing surprise in the data is not that revenue from brick-and-mortar casinos and even horse racing continues to soar to new heights. All of it is dwarfed by the sheer magnitude of money spent on scratch-offs and Powerball tickets across the US.

“Even more than casino gambling, the lottery is something that’s really part of the fabric of this country,” Ramsey said. “Most of us that work in gambling and around gambling just know what a bad bet it is. But for the general population, it’s the No. 1 form of gambling in the country.”

Intriguingly, lottery executives have long shirked the association with the casino industry and insisted they’re not in the gambling racket. Ramsey noted that lottery games increasingly resemble the graphics of slot machines and other casino-related activities.

Feldman added:

“So many of them try to make it as if they’re not in the gambling business at all, that they’re in the scholarship business, they’re raising money for public works. They’ve always wanted to hold themselves out that they’re something different.”

Feldman, who believes the casino industry’s spectacular growth and public acceptance in the past few decades stem from Las Vegas showing the world how to package gambling inside a diverse resort and entertainment experience, has this thought on what propels interest in the lottery:

“You’re having a moment of fantasy that something great is going to happen to you and you’re willing to pay $2 to see if that fantasy might come true. The majority of people know their chances of winning a lottery are infinitesimally small. But it’s the, ‘Wow, if I got handed a check for $40 million, I’m gonna do this. And then I’m going to do this.’ Now you’re talking to your friend, and your friend says, ‘I’d do that second thing first.’ That’s the entertainment value.”

How online gambling will shape the rest of the industry

According to Feldman, the industry should benefit from the expansion of online gambling, sports betting and lotteries, as long as these products are perceived as honest and fair. One big game-fixing or lottery scandal and the public’s faith could be shattered. Feldman said:

“I don’t know that I would say there’s a ceiling to the economic value of this industry because it’s continuously growing and changing and finding new ways to engage people, but the threat to the online folks in particular is either bad management or out-and-out dishonesty in sports gambling, in particular. The moment you hear that those outcomes were manipulated by something and the operator didn’t catch it, that’s going to be a major problem.”

Ramsey, likewise, predicts stability and economic growth as a result of the expansion of online gambling. “Anytime you can make gambling more available to more people, you’re going to make it a more consistent, more profitable industry.”