In the digital age, where the internet has dissolved international borders, the online gambling sector offers a unique perspective on cultural and economic integration.

This analysis explores the online gambling environments in India and Brazil, two economically robust nations with diverse cultural settings.

Demographic and Games Dynamics

India’s online gambling market is largely influenced by its young population, with over three-quarters under the age of 45. Cities like Bangalore and Hyderabad are at the forefront of this digital gambling trend.

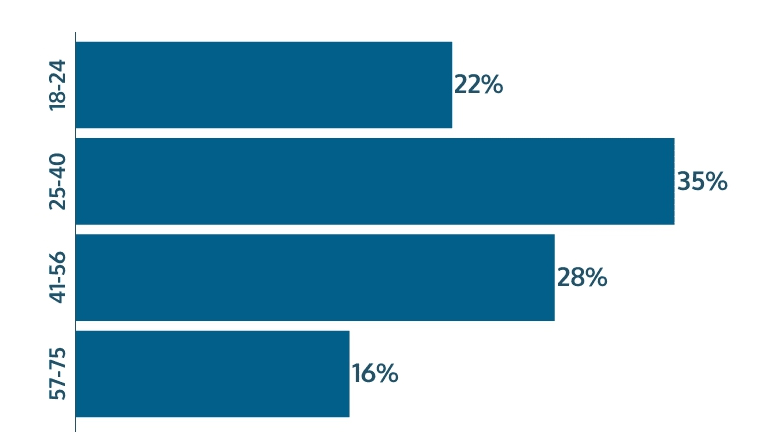

In contrast, Brazil’s average online gambler is around 39 years old according to ENV Media Research, with the most active age group being 25-40 years, representing over half of the gambling community. Most Brazilian gamblers are found in large cities, with São Paulo leading with nearly a quarter of all real-money players, followed by Rio de Janeiro at 14%. Both countries share a similar demographic profile of online gamblers.

ENV Media has previously highlighted classic casino games such as roulette, blackjack and baccarat are the most popular games in India. Comparing the popularity with Brazil, KTO has reported slot games as the most popular category, achieving 89.70% popularity.

Economic Factors

In India, the online gambling sector is primarily supported by the middle and upper classes, despite widespread economic disparities. Goa and Sikkim stand out as gambling hotspots due to legal allowances and economic prosperity.

Similarly, in Brazil, the majority of real-money gamers come from wealthier households. The Brazilian Economic Classification Criteria categorizes households from A (wealthiest) to D–E (least affluent). Levels A and B, representing the wealthier segments, account for over half of the real-money gamers. This indicates a significant contribution from the upper class to the online gambling scene.

Online Gambling Interests

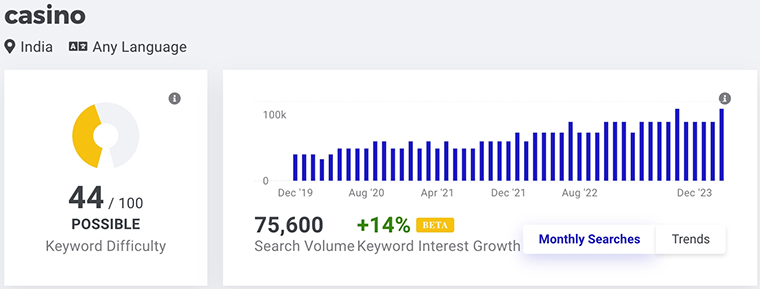

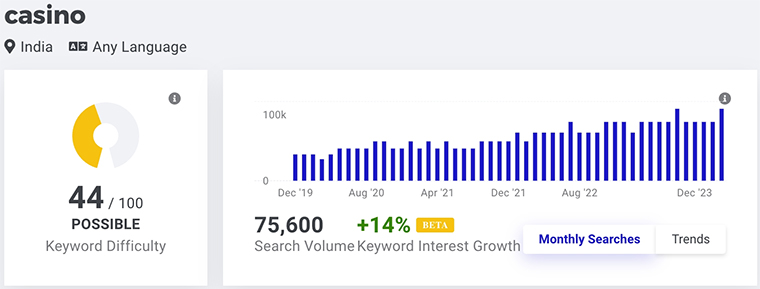

Mangools.com – Searches in India

India’s rapid adoption of technology, with over 759 million active internet users and affordable smartphones, has led to a mobile gaming boom. Brazil mirrors this trend, with most online gambling occurring on mobile devices, showing a high level of digital integration.

However, there’s a notable difference in the interest in online casinos and sports betting between the two countries. In Brazil, “Cassino” generates 123,000 searches per month, while in India, “Casino” garners around 95,000 searches. For online sports betting, Brazil’s “Aposta” sees 200,000 monthly searches, far surpassing India’s 11,000 for “betting”.

Regulatory Landscape in Brazil

Recently, the Brazilian Chamber of Deputies approved a bill regulating online gambling, known as “bets” (PL 3626/23). This legislation imposes taxes on companies and bettors, sets rules for service exploitation, and outlines revenue sharing. The government anticipates increased revenue from this regulation, contributing to its deficit reduction goals.

The bill faced opposition from the evangelical parliamentary front, concerned about societal impacts. The Chamber’s president, Arthur Lira, emphasized the need for regulation to prevent issues like uncontrolled gambling and money laundering. The legislation also mandates a 15% income tax on net winnings and requires companies to have Brazilian nationals holding at least 20% of the capital. Additionally, it includes measures to combat money laundering, encourage responsible gambling, and prevent fraud and bet manipulation.

Brazil’s Growing Market

Despite a smaller population compared to India, Brazil’s online gambling industry is poised for significant growth. This expansion is partly due to the recent regulatory changes, which have made the market more structured and safer for players. In contrast, India’s lack of regulation in this sector has hindered its growth potential, despite similar demographic and economic interests.

While India and Brazil share similarities in the demographic profile of online gamblers and the influence of economic classes, the regulatory environment in Brazil, with its recent legislative changes, sets it apart. This new framework is likely to foster a more controlled and thriving online gambling industry in Brazil, contrasting with India’s unregulated and potentially risky market.