- Crypto ownership is sometimes seen as a gateway to investing – but the risks are high

- Regulating crypto as gambling could mean a lower regulatory burden

The “wild west” crypto industry has just become even more rip-roaring, thanks to a stand-off on how speculative tokens should be regulated.

The Treasury Committee group of MPs has called on the government to reconsider its plans to bring crypto assets under existing financial services regulation. Members argued last week that large parts of the industry “remain a wild west”, and said the trading of cryptocurrencies, such as bitcoin, more closely resembled “gambling than a financial service” and should be “regulated as such”.

At the heart of the debate is the fact that crypto can result in some very bad outcomes for investors. The Financial Conduct Authority (FCA) has already warned DIY investors that they need to be prepared to lose all of their money when buying crypto assets. Research from the Bank of International Settlements, a central bank umbrella body, suggested that around three-quarters of users had lost money on cryptocurrencies, raising concerns that investors were not “fully informed of the risk or volatility in crypto”.

This is no longer a niche issue. Such assets are astonishingly widespread: it is thought that around 10 per cent of UK adults – 5mn people – hold crypto assets. Laith Khalaf, head of investment analysis at AJ Bell, points out that this is only just shy of the 6mn people who hold a stocks-and-shares individual savings account (Isa). “The conclusion must be that many people are leap-frogging tried and tested financial products, and diving straight into the deep end with crypto”, he said.

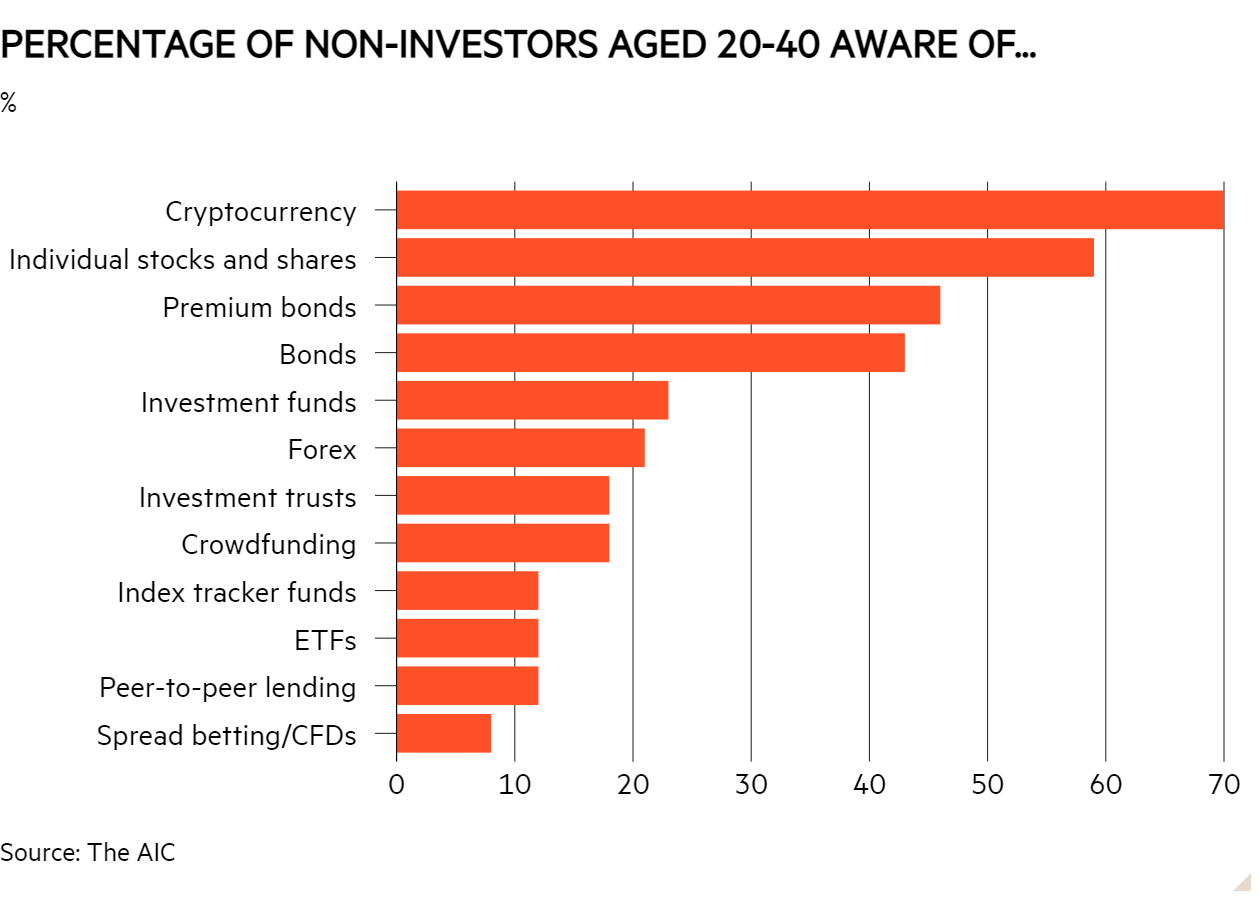

April research from the Association of Investment Companies (AIC) supports the idea that crypto is a ‘gateway’ for inexperienced investors. The AIC found that 70 per cent of non-investors aged 20 to 40 were aware of cryptocurrency, ranking it far ahead of individual stocks and shares, bonds and investment funds (see chart). The young people surveyed reported that the biggest barriers to investing were a lack of knowledge followed by a lack of savings. The FCA estimates that the majority of crypto investors have less than £1,000 in tokens, and that only 7 per cent have more than £5,000.

There are reasons why crypto appeals. Investors have been enticed by the huge headline returns from bitcoin. “They probably think the small amount of money they have to put aside will never be enough to get on the housing ladder unless they magnify it tenfold,” Khalaf said. But although crypto offers them a shot at achieving this, so does a roulette wheel. “Both may also leave you empty-handed,” he added.

Though the personal risks of crypto assets are clear, the spillovers associated with the industry are more hotly debated. Charles Randell, former chair of the FCA , told the Treasury Committee that “the social purpose of regulated financial markets is to facilitate economic growth by enabling people’s savings to be channelled to productive business ventures”. He added that regulating crypto assets as financial services risked ‘endorsing’ them “even though it provides no useful service for consumers”.

Not everyone agrees: Gavin Brown, associate professor in Financial Technology at the University of Liverpool, said last week that “to conclude that cryptocurrencies have no value because they lack a traditional asset base fails to understand that intrinsic value we can derive from a network”. He claimed that the networks that underpin cryptocurrencies do have underlying assets of value, and that the tokens simply represent “a value proposition which may or may not come to fruition”.

The negative spillover effects of crypto assets are also contested. Following the report, a Treasury spokesperson maintained that the risks posed by crypto were “typical of those that exist in traditional financial services”. In comments reported in the Financial Times, they added: “It’s financial services regulation – rather than gambling regulation – that has the track record of mitigating risks”.

There is also a risk that regulating crypto like gambling could inadvertently expose providers to less scrutiny. AJ Bell’s Khalaf said last week that treating crypto as gambling removed the industry from some of the extremely onerous requirements placed upon financial services firms. Though to the individual crypto might look more like gambling than investing, regulating it as such could actually end up giving the industry an easier ride.