COLUMBIA, Mo. (KMIZ)

Major players in the world of sports betting have spent millions of dollars to win votes for and against Amendment 2 on Missouri’s November ballot.

Two groups are running ads on television to support and oppose the measure, which would legalize sports betting in the state and place a 10% tax on money made to go toward state education.

How it works

If passed, the Missouri Gaming Commission will license and regulate sports betting in the state beginning no later than Dec. 1, 2025. Each of Missouri’s 13 casinos and six of the state’s professional sports teams can all apply for a license to offer sports betting at their establishments and for mobile betting.

The state will offer another two mobile licenses that are “untethered” to a physical location. The retail licenses will cost no more than $250,000 while the mobile licenses will cost no more than $500,000. Money made from the licenses and their renewals every five years will first pay the MGC for its operational expenses and then go to the Compulsive Gambling Prevention Fund.

The amendment requires gambling platforms to send 10% of their monthly gross revenue to the Missouri Department of Elementary and Secondary Education for use as it and lawmakers see fit. Those platforms are first allowed to deduct money from its bottom line in several ways before calculating their tax. The MGC estimates that the state will collect more than $6 million in its first year of operation for education and is expected to climb to about $20 million every year for the next four years.

A DESE spokesperson said any money it receives will go through the usual state appropriations process, leaving legislators the ultimate decision-makers for how the funds are spent.

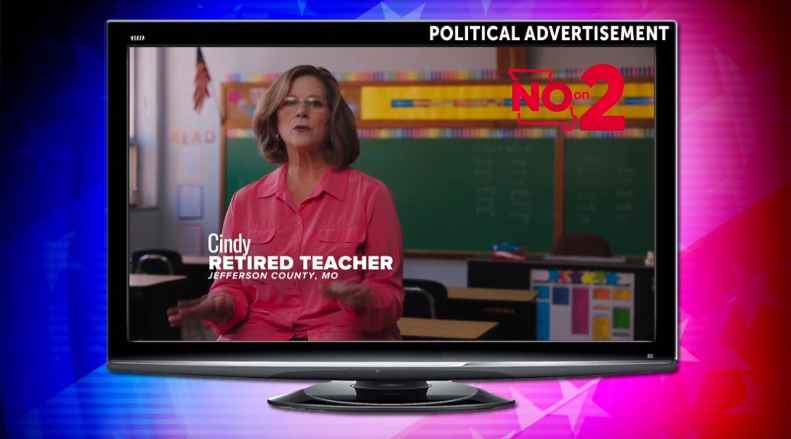

The advertisements

Winning for Missouri Education is promoting the measure, buoyed by millions of dollars from sports betting platforms DraftKings and FanDuel. The group’s advertisements focus on the possibility of millions of dollars coming in for the Department of Elementary and Secondary Education.

The group opposed to it, Missourians Against the Deceptive Online Gambling Amendment, gets money from casino company Caesars Entertainment and some of its Missouri casinos, including Boonville’s Isle of Capri. The ads highlight the state auditor’s fiscal note that floats a scenario in which gambling platforms pay no money to DESE after taking numerous deductions from their monthly revenue allowed under the amendment. This includes certain deductions for promotional bets and for undefined federal taxes.

Those deductions lead to one advertisement claiming that “[n]othing in [Amendment] 2 guarantees a single penny for education.”

“I don’t think there’s a world where it’s zero dollars,” Jan Zimmerman, the chairwoman of the Missouri Gaming Commission told ABC 17 News about the ads. She said the December 2025 deadline gives them time to figure out how it will dole out licenses and conduct oversight of the platforms remitting taxes. Zimmerman said the MGC has talked with other states that have legal gambling to prepare itself should the amendment pass.

“We’ve had some states that our state has been in contact with that said, ‘Oh, gosh, don’t do what we do, ours doesn’t work,’” Zimmerman said. “Because we have the advantage of sports betting being after-the-fact of other jurisdictions, that we’re able to pick and choose what’s working and what’s not.”

Winning for Missouri Education spokesman Jack Cardetti points to that same fact in how Amendment 2 limits some of the deductions gambling platforms can make. One infamous example is Kansas, which received $1,134 on $194 million in bets the month the Kansas City Chiefs won Super Bowl 57. The platforms partly achieved it through a deduction on free play or promotional bets, where bettors are offered extra money by the platforms to wager. Kansas did not limit how much money operators could deduct based on those bets.

Amendment 2 puts a cap on such deductions. Platforms in Missouri could only deduct promotional credits from its revenue up to 25% of the total monthly amount.

“We’ve learned how to do this better in Missouri than other states because we’re the 39th state able to do that,” Cardetti said.

Brooke Foster, spokesperson for the group opposing Amendment 2, said the state and its lawmakers will ultimately still decide how tax dollars get spent. While the measure does require the tax money to be sent to DESE, Foster said the appropriations process can still leave the department without a gain.

“Almost like a shell game,” Foster said. “So they can take $10 out of education funding, put $10 back in from the general fund, so it’s not a net gain. There’s just no way of saying that there’s going to be this much more for education.”

Winning for Missouri Education’s advertisements partly focus on teacher pay in the state, which ranks among some of the worst average salaries for public school teachers in the United States. While the amendment does not guarantee gambling revenue will go specifically toward teacher pay, Cardetti believes districts will make raising pay a priority.

“That’s obviously their option at the local level, what they’re going to use these new resources for, but we really believe that teacher pay will be part of it,” Cardetti said.

Noelle Gilzow, head of the Columbia Missouri National Educators Association, told ABC 17 News that she doubts the gambling money will make a significant difference in teacher pay. She said she feared state lawmakers may actually cut general revenue funding to public education in lieu of the new taxes the state collects.

Cardetti criticized Caesars Entertainment for pumping money into the state to oppose Amendment 2. He said the casino company benefits from the “status quo” in Missouri, where sports bettors might go across state lines to place a bet at a Caesars-run casino there.

“It makes no sense to have a public policy that actively pushes people that want to bet on sports to other states and other classrooms in other states,” Cardetti said.

Foster said Caesars is not opposed to sports gambling, but thinks the amendment benefits DraftKings and FanDuel greater than the state. While the ads paid for by a Las Vegas-based company criticize “out-of-state gambling operators,” Foster pointed out the three casinos Caesars has in the state and the effect mobile betting untethered to a physical spot might have on them and their workers.

“They’re certainly not opposed to sports gambling because that’s just part of their portfolio now for casinos,” Foster said. “They’re opposed to the way the measure is written. They wish that it would do more for Missourians and for their own workers.”

Another advertisement in opposition called sports betting “the Lottery 2.0” in its promises to raise money for schools. This refers to the 1992 vote that sent any net revenue from the Missouri Lottery to public education instead of general revenue.

The Missouri Lottery website reports more than $537 million will go toward education this fiscal year, making up about 4% of DESE’s total budget. A state audit in 2023 found that the lottery sent more than $400 million to DESE for fiscal year 2022.