Finances are top of mind for many Americans right now. With inflation and an uncertain economy, there’s a lot of instability, and it appears many people aren’t prepared for it.

Our new survey of more than 1,000 Americans asked people to take a hard look at their bank accounts. We found more than half (51%) are living paycheck to paycheck right now. While some people have a hold of their finances, many others appear to be gambling on their future.

America’s Personal Finances

Right now, more than 2 in 5 (42%) Americans would not be able to cover an unexpected $1,000 expense. That being said, more than half (56%) have emergency funds.

On average, Americans have about $8,500 tucked away for a rainy day, and for many, that day has already come. Nearly half (48%) have used money from an emergency fund, and more than 1 in 5 (21%) have withdrawn from a 401K or IRA.

96% of people manage their finances themselves. Despite that, 1 in 4 (26%) are not confident in their ability to manage money. Only 1 in 10 (12%) said they currently have a financial advisor.

While 85% are open to financial advice from others, 15% would prefer people keep their recommendations to themselves.

Others don’t keep a close eye on their bank accounts at all and are not pulling out the calculator to budget regularly. In fact, nearly 1 in 3 (27%) do not budget at all. Gen Zers are the worst at it (31%) followed by Gen X (26%), Baby Boomers (26%), and Millennials (25%).

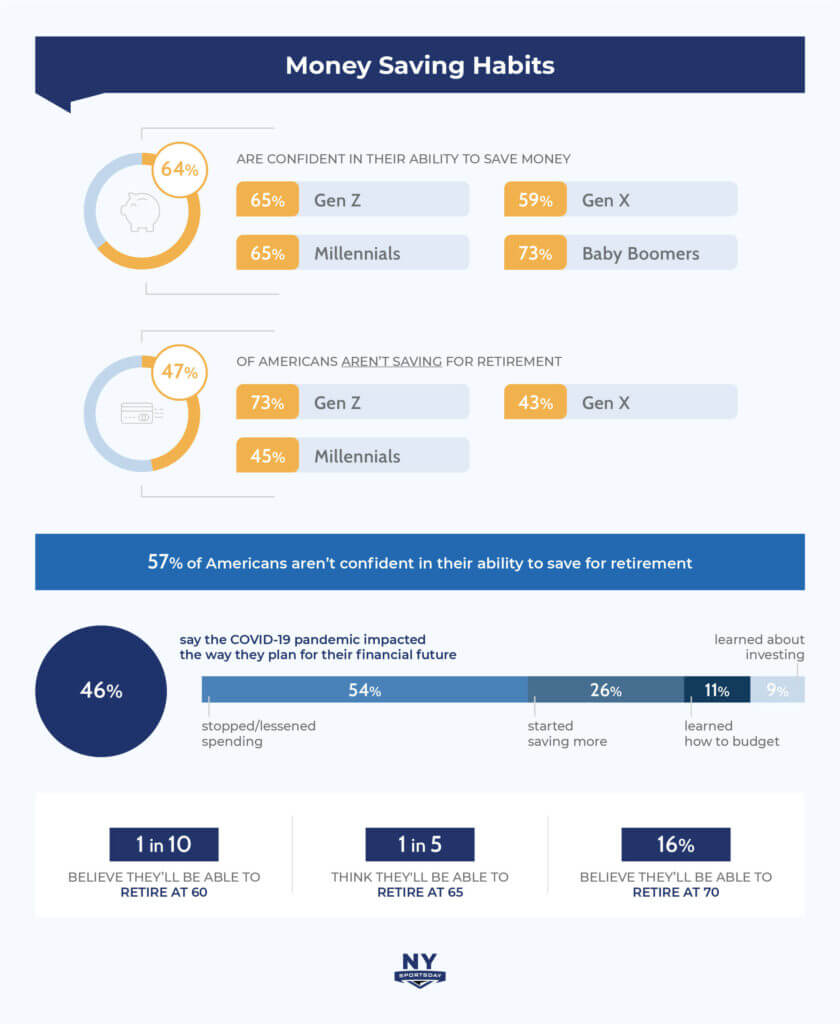

Nearly half (46%) say the pandemic has impacted the way they manage their personal finances. More than half (54%) stopped spending as much money, and 1 in 4 (26%) started saving more.

More than 3 in 5 (64%) Americans say they are good at saving money, but 47% are not currently saving for retirement. When asked specifically about saving for retirement, 57% admitted they are not confident in their ability to save for it.

Only 1 in 10 believe they’ll be able to retire at 60. About 1 in 5 think they can retire at 65, and 16% don’t think they’ll be able to retire until at least 70.

More than 4 in 5 (84%) are worried about the current state of the economy. Right now, more than half (54%) don’t feel confident about the financial future. Those most concerned are Gen Xers (59%) followed by Millennials (54%).

Because of that, 49% said they are not taking any financial risks at the moment. Only 1 in 3 (32%) have taken a financial risk in the last 12 months. The generation that takes the most risks are Millennials (35%).

Right now, more than 3 in 5 (64%) have debt. On average, Americans are in the red by about $25,139. Aside from saving and working with financial planners, some have taken a riskier route to try and get out of debt.

Nearly 1 in 10 (8%) admitted to trying to get out of debt by playing the lottery. Nearly 1 in 6 (15%) buy a lottery ticket anytime there’s a major jackpot, and 13% buy tickets several times a year! On average, people have spent $46 on lottery tickets in the last year and won $156 on average.

Whether you try your luck in the lottery or painstakingly budget for every penny you make, finances are tricky. Spend your money wisely and we hope 2023 is a prosperous year for all.

As the state considers the prospect of legalizing online casinos in New York, it’s important to keep in mind how people in the shadow of Wall Street look at their personal finances.

Methodology

In October 2022, we surveyed 1,001 Americans about their financial habits. Survey respondents ranged in age from 18 to 83 with an average age of 38. 49% are men, 49% are women, and 2% are nonbinary. The household income of respondents ranged from $22,000 or less (13%), $20,000-$40,000 (22%), $40,0001-$60,000 (21%), $60,001-$80,000 (15%), $80,0001-$100,000 (10%), $100,001-$200,000 (15%), and $200,001+ (4%).

For media inquiries, please contact [email protected]

Fair Use

When using this data and research, please attribute by linking to this study and citing nysportsday.com

Right now, more than 2 in 5 (42%) Americans would not be able to cover an unexpected $1,000 expense. That being said, more than half (56%) have emergency funds.

On average, Americans have about $8,500 tucked away for a rainy day, and for many, that day has already come. Nearly half (48%) have used money from an emergency fund, and more than 1 in 5 (21%) have withdrawn from a 401K or IRA.

96% of people manage their finances themselves. Despite that, 1 in 4 (26%) are not confident in their ability to manage money. Only 1 in 10 (12%) said they currently have a financial advisor.

While 85% are open to financial advice from others, 15% would prefer people keep their recommendations to themselves.

Others don’t keep a close eye on their bank accounts at all and are not pulling out the calculator to budget regularly. In fact, nearly 1 in 3 (27%) do not budget at all. Gen Zers are the worst at it (31%) followed by Gen X (26%), Baby Boomers (26%), and Millennials (25%).

Nearly half (46%) say the pandemic has impacted the way they manage their personal finances. More than half (54%) stopped spending as much money, and 1 in 4 (26%) started saving more.

More than 3 in 5 (64%) Americans say they are good at saving money, but 47% are not currently saving for retirement. When asked specifically about saving for retirement, 57% admitted they are not confident in their ability to save for it.

Only 1 in 10 believe they’ll be able to retire at 60. About 1 in 5 think they can retire at 65, and 16% don’t think they’ll be able to retire until at least 70.

More than 4 in 5 (84%) are worried about the current state of the economy. Right now, more than half (54%) don’t feel confident about the financial future. Those most concerned are Gen Xers (59%) followed by Millennials (54%).

Because of that, 49% said they are not taking any financial risks at the moment. Only 1 in 3 (32%) have taken a financial risk in the last 12 months. The generation that takes the most risks are Millennials (35%).

Right now, more than 3 in 5 (64%) have debt. On average, Americans are in the red by about $25,139. Aside from saving and working with financial planners, some have taken a riskier route to try and get out of debt.

Nearly 1 in 10 (8%) admitted to trying to get out of debt by playing the lottery. Nearly 1 in 6 (15%) buy a lottery ticket anytime there’s a major jackpot, and 13% buy tickets several times a year! On average, people have spent $46 on lottery tickets in the last year and won $156 on average.

Whether you try your luck in the lottery or painstakingly budget for every penny you make, finances are tricky. Spend your money wisely and we hope 2023 is a prosperous year for all.

As the state considers the prospect of legalizing online casinos in New York, it’s important to keep in mind how people in the shadow of Wall Street look at their personal finances.

Methodology

In October 2022, we surveyed 1,001 Americans about their financial habits. Survey respondents ranged in age from 18 to 83 with an average age of 38. 49% are men, 49% are women, and 2% are nonbinary. The household income of respondents ranged from $22,000 or less (13%), $20,000-$40,000 (22%), $40,0001-$60,000 (21%), $60,001-$80,000 (15%), $80,0001-$100,000 (10%), $100,001-$200,000 (15%), and $200,001+ (4%).

For media inquiries, please contact [email protected]

Fair Use

When using this data and research, please attribute by linking to this study and citing nysportsday.com