The shocking death of a father-of-three who fell from a cruise liner after racking up debts in the ship’s casino has sparked calls for government intervention into gambling practices in international waters.

Shane Dixon, 50, plunged to his death from the P&O cruise ship Pacific Adventure just after 4am on May 6 as it approached Sydney Harbour.

His family believes he panicked after the consequences of an outstanding $4,000 debt from the ship’s casino began to sink in.

He had also run up $5000 losses at the gambling tables the night before, which his mother, who was travelling with him, had stepped in to cover.

‘His brain was probably going 100 miles an hour. He probably thought, “s***, I’ve done it again, I can’t afford it and I can’t ask mum for more money”,’ Shane’s brother Scott Dixon told Daily Mail Australia.

The CEO of the Alliance for Gambling Reform Carol Bennett said the cruise ship operator had failed to provide Shane with an adequate duty of care.

Shane Dixon, 50, is pictured with his mother Sue Dixon – who saved up to take them on the ship

Shane died after falling from P&O’s Pacific Adventure cruise ship on May 6

‘It’s really concerning that when a ship sails 12 nautical miles off the coast it can then allow anything and everything to happen,’ she told Daily Mail Australia.

‘The rules that might apply on land no longer seem to apply and yet you would expect this cruise line would have some kind of duty of care to ensure that people are not plied with inducements, promotions and advertisements that are pushing them to gamble to extremely harmful levels.

‘It is just beyond belief that there is not an expectation that when a cruise ship leaves a dock that the rules of that jurisdiction apply.

CEO of the Alliance for Gambling Reform Carol Bennett is pictured

‘But clearly that’s not the case and we leave it all in the hands of the cruise line operator who may or may not apply the responsible service of gambling.’

She said if Shane had been offered inducements the operator needed to bear the responsibility of the ‘appalling breach of duty of care’.

Scott said his mother and brother had been having a good time on the Elvis-themed cruise before Shane entered the casino.

Ahead of the holiday, Scott said his brother was struggling both financially and with the breakdown of his marriage and deaths of their brother and father.

‘Mum said they were having fun, everything was good. But the casino – they use all of these incentives to tell people, “Come back, come back”,’ he said.

In Australia, strict laws govern how gaming providers can advertise gambling. Promotions such as giving patrons free booze, gambling vouchers and prizes to encourage them to spend are all banned.

However, cruise ships that operate casinos in international waters can bypass these regulations – offering a lucrative loophole to the rules.

Punters also don’t need to pay upfront and can charge what they gamble straight on to their room bill – making it easier to spend and harder to track.

Ms Bennett said it was ‘fundamental’ that gamblers were able to set spend limits, self-exclude themselves and be in an environment free of inducements.

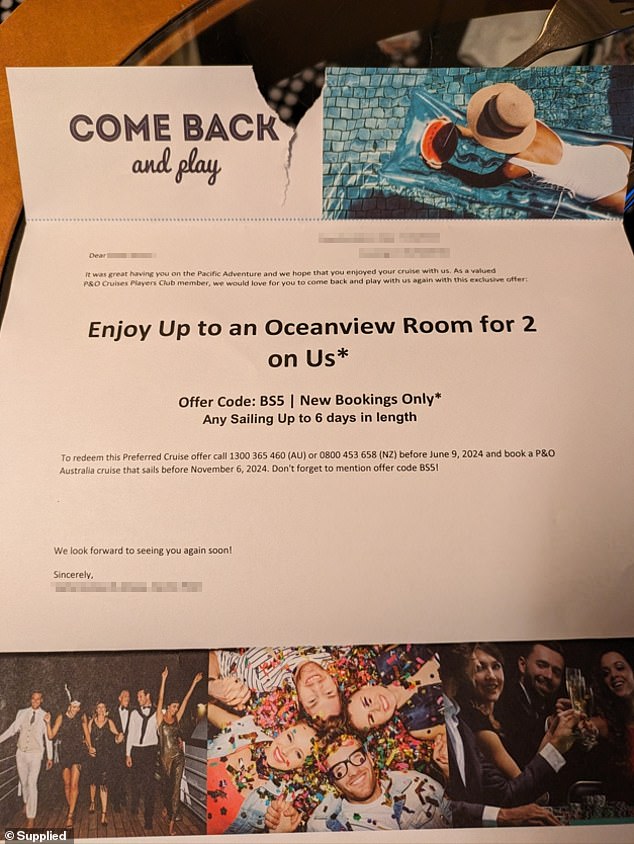

A promotional voucher offered by P&O to casino players, urging them to ‘come back and play’

‘This is just basic harm reduction that any provider or organisation that is providing gambling services should be complying with,’ she said.

‘And if they’re not, we need to really seriously think about what governments need to do to address this problem because you do wonder how widespread this is.

‘This could be just the tip of the iceberg.’

Ms Bennett said Australia loses an estimated $25billion on legal forms of gambling each year and that the consequences are far-reaching.

‘It leads to everything from domestic and family violence to health and mental health issues, anxiety, depression, financial distress, right through to suicide,’ she said.

‘It is a huge and to some degree hidden problem in Australia, which is why we need stronger enforcement of safeguards and guardrails around gambling that don’t see people led into a situation where they see no other way out but suicide.’

She said because the government accepts large amounts of revenue from the gambling industry the devastating impacts could be ‘swept under the carpet’.

‘I think most people would be pretty appalled to know that there are no rules here, that we allow this situation to happen and it’s not taken seriously enough, not only by our governments, but by these companies who have a duty of care and just don’t consider that it’s something they should be taking seriously,’ she said.

‘These are peoples lives. For every person who gambles, there are six people around them who are going to be directly impacted.’

Shane Dixon, 50, plunged to his death from the P&O cruise ship Pacific Adventure just after 4am on May 6 as the vessel approached Sydney Harbour

Labor backbencher Graham Perrett said the British cruise line most likely operated under the UK’s gambling laws.

‘My understanding is that the UK gambling laws are not dissimilar to ours in terms of marketing and advertising,’ he told Daily Mail Australia.

‘It’s not just a gambling free-for-all, even if they are outside our territorial seas they still have to follow the laws of the UK.’

Labor backbencher Graham Perrett

Mr Perrett said operators needed to communicate to their customers that once they were in international waters ‘they’re not in Kansas anymore’.

‘If a company is engaging with Australian customers they should make people aware of the fact that things change when you move from 12 nautical miles to even 24 nautical miles away from land,’ he said.

‘I would respectfully suggest people be aware of what laws would apply in terms of investigating the death of Mr Dixon or others if they get into trouble.

‘When it comes to the Australian government talking to the UK government there isn’t a problem as we’ve got good connections between these two legal systems.

‘But it can become more complicated in what they call a multiplicity of jurisdictions.’

A high-roller who is a member of P&O Cruises’ casinos VIP program, the Players Club, said the strategies used to promote gambling are ‘predatory’.

While he always plans what he spends and only takes cash, he said the methods used would be hard to resist for people who struggle with gambling addiction.

‘They are essentially offshore casinos that come and pick people up from shore and take them out to international waters to gamble,’ the man, who wished to remain anonymous, told Daily Mail Australia.

Pictured: Photos of the ill-fated trip that Shane posted online before he boarded the cruise

‘They provide players with very generous incentives to return which wouldn’t be legal in Australia, including unlimited drinks where RSA does not apply.

‘If you don’t have the means to pay and you have an issue, there is no one to stop you so you can rack up a large amount of debt.

‘Then they close them down as the ship returns to shore, because they can’t legally operate them in Australia.’

A P&O spokeswoman told Daily Mail Australia it would be inappropriate to comment on the tragic death of a guest while a coroner’s investigation is carried out.

‘We have Responsible Conduct of Gaming Policies in place on all P&O ships and take those policies seriously,’ she said.

‘We are cooperating fully with the coroner’s investigation.’

For confidential support 24/7 call Lifeline 13 11 14 or Beyond Blue 1300 224 636

For gambling support 24/7 call the National Gambling Helpline on 1800 858 858