(Bloomberg) — Shares of Mexican soccer and gambling business Ollamani SAB surged Tuesday following its spinoff from pay TV operator Grupo Televisa SAB, driving the market value of the newly listed company to around 4.3 billion Mexican pesos ($252 million).

Most Read from Bloomberg

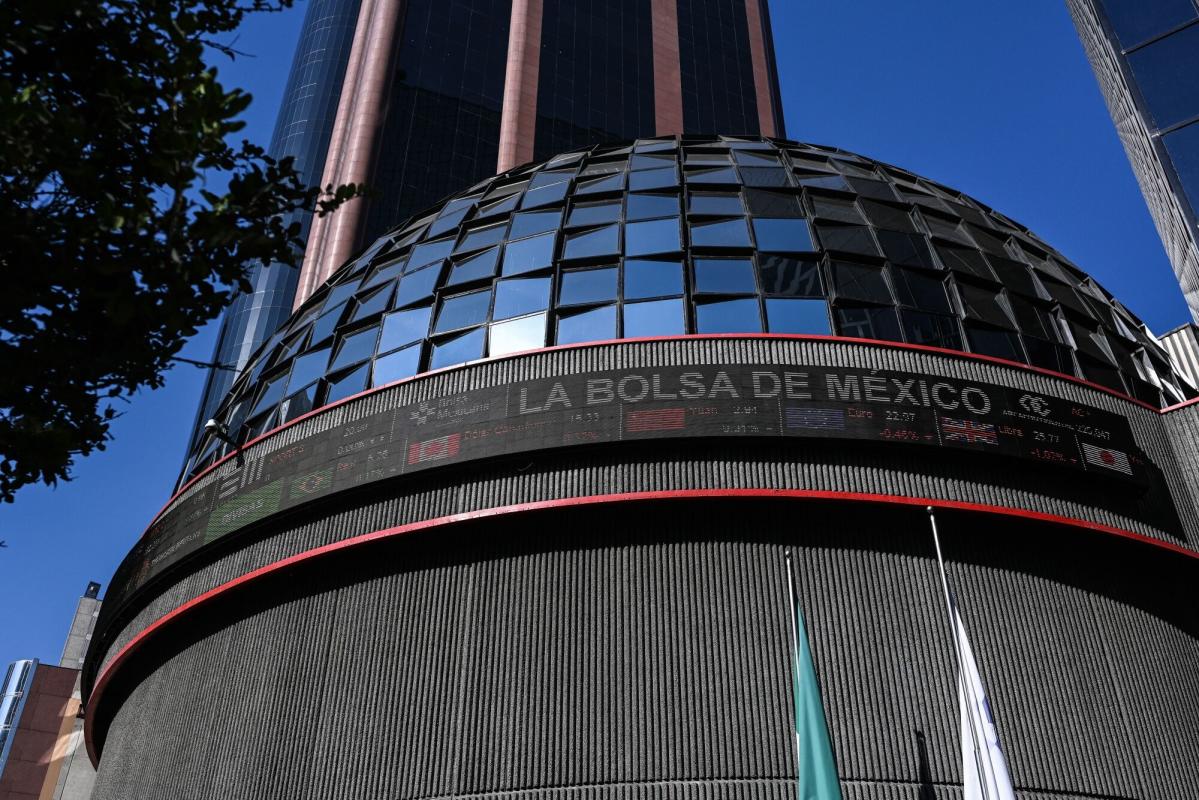

Ollamani SAB shares nearly tripled, rising 157% to 29.53 pesos per unit after pricing at an initial 11.50 pesos per unit in an auction before the market open, according to data from the Mexican stock exchange. Parent company Televisa priced at 10.86 pesos per unit in the auction and rose 2.9% to 11.17 pesos, its highest since early December.

The spinoff created Mexico’s first listed sports and gaming company and aims to unlock value from Televisa shares, which tumbled to a nearly 28-year low in October. Televisa shares have risen 16% since the company announced a date for the spinoff on Jan. 25.

Ollamani’s assets will include the Club America soccer team and Mexico’s biggest soccer stadium, Estadio Azteca, which is set to be one of the venues for the FIFA World Cup in 2026. The stadium will undergo an initial renovation estimated at 900 million pesos in 2024, according to a filing. Ollamani may take on additional debt to complete the project, the filing said.

Emilio Azcarraga Jean, the controlling shareholder of Televisa as well as Ollamani, was looking at purchasing more shares for up to 30% of the spinoff, according to a filing with the Securities and Exchange Commission.

The company’s gaming division operates 18 casinos while the publishing business includes titles such as TV y Novelas, a weekly entertainment magazine.

The shares trade under the ticker AGUILCPO, a reference to Club America’s nickname of Aguilas, or eagles. Ollamani means ball game in Mexico’s native nahuatl language.

–With assistance from Andrea Navarro, Edgar Martin Espinoza Barreras and Eduardo Cahuantzi.

(Updates share move, adds details on controlling shareholder in paragraph six.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.