Sports gamblers in New Jersey now have a new way to profit off their favorite NFL player’s success.

Mojo, a startup backed by billionaire Mark Lore, former New York Yankee Alex Rodriguez, and Tiger Global Management, allows investors to buy shares of stock in professional athletes with future statistics driving potential price appreciation.

“It’s a sports stock market, and the premise is for the everyday sports fan to basically be able to invest in the careers of athletes like stocks,” Vinit Bharara, MOJO co-founder and CEO, told Yahoo Finance Live (video above). “They can use their sports knowledge to basically pick players they think are going to do well and profit from that.”

The company launched its app in New Jersey on Monday through a betting license partnership with Caesars (CZR), but also has partnerships with Penn Entertainment (PENN) and “other” gambling operators to eventually add services in nine more states.

© Provided by Yahoo Finance US Sports gamblers can use the Mojo app to invest in their favorite athletes. (Photo: Mojo)

Mojo isn’t quite a direct competitor to the aforementioned gambling companies or emerging online sportsbooks like FanDuel (FLTR.L) and DraftKings (DKNG). Those companies largely make money from gross gaming revenue, a product of gamblers losing money to the house on wagers.

Mojo operates more like a stock exchange akin to Robinhood (HOOD) or E*TRADE (MS). The company aims to generate revenue from “small commission transactions.”

“We like to say it’s where Robinhood meets DraftKings, but instead of you investing in Amazon or Google, you can invest in Joe Burrow or LeBron James, players that you can see every night, that you feel like you have some knowledge about,” Bharara said.

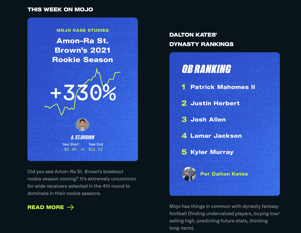

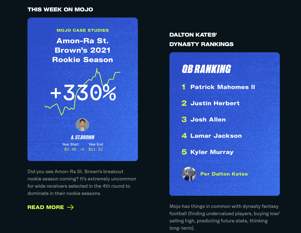

Mojo makes the initial market and sets the price for players but from there, the market is all driven by statistics. Career-end projected statistics are the driver of price moves. For example, if Kansas City Chiefs quarterback Patrick Mahomes threw for more touchdowns than normal, his projections would shift higher, thus boosting the price.

Just like in the real stock market, though, bad news that forecasts potential poor performance down the line can sink shares. Last weekend, San Francisco 49ers quarterback Trey Lance left the field with a likely season-ending injury. His stock fell 15% at the “market open” on Monday.

© Provided by Yahoo Finance US Mojo predicts future stats for NFL players. (Photo: Mojo)

Still, Bharara noted, an “important premise” of Mojo’s market is that when an investor owns stock in a player, they are “basically guaranteed” a payout based on that player’s on-the-field statistics at the end of their career, no matter how early on in a career that might be.

With career stats as a consistent market driver, Bharara and his team hope Mojo users will use the app like investors.

There’s no cap to the amount of money that can be deposited onto the platform or time limit on how long a share can be held. An investor could go long on a player like seven-time Super Bowl champion Tom Brady from the start of his career and turn what would’ve been a $3 stock into a $180 value today.

“For us, this idea that it’s based on their career but also based on these objective stats, you know as an owner that there’s this value you can rely on, and it anchors how prices move,” Bharara said.

—

Josh is a reporter and producer for Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube