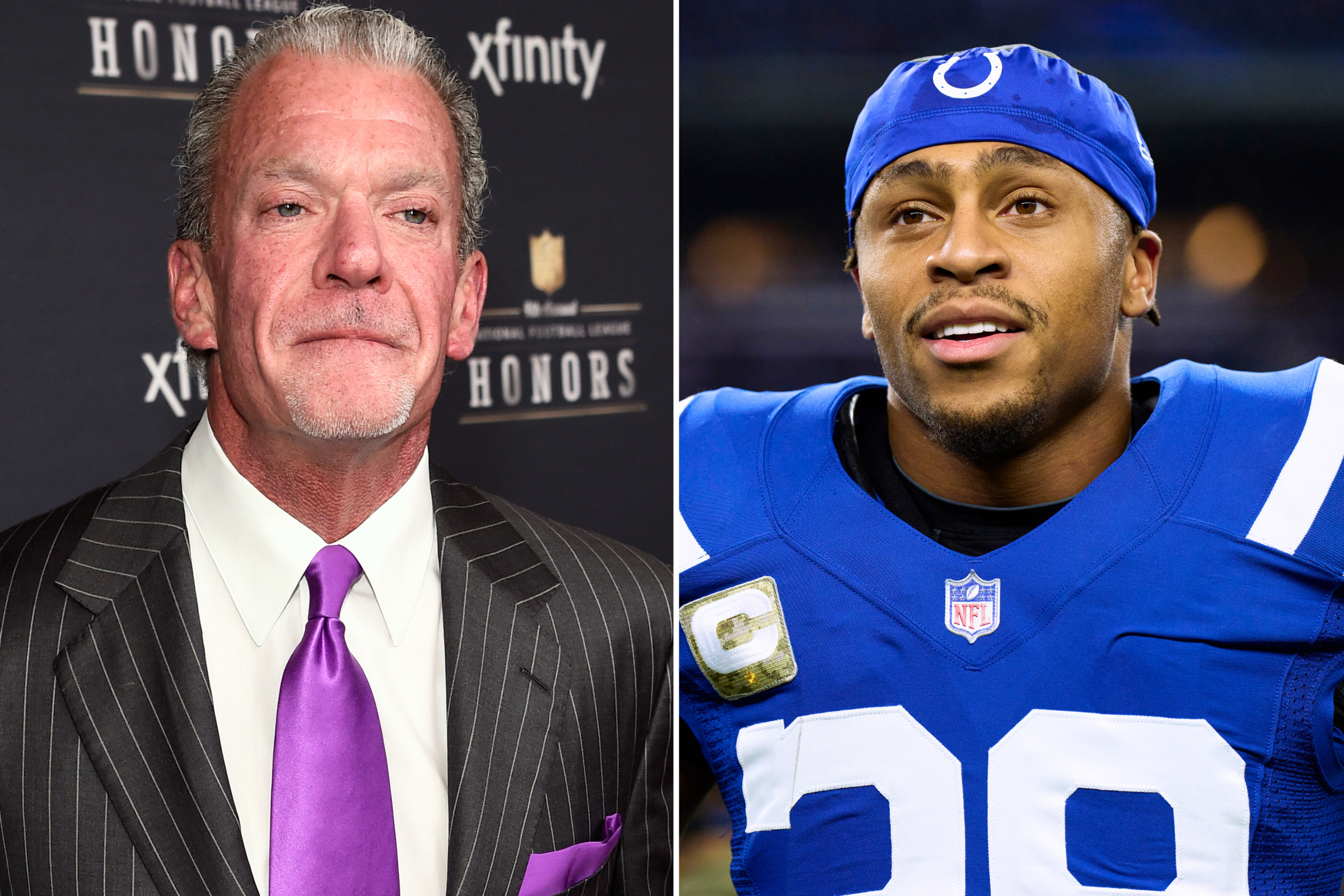

While some NFL owners remain largely anonymous, Jim Irsay isn’t shy about stepping into the public eye. And, whether he meant it or not, the Jonathan Taylor trade saga put Irsay and his Indianapolis Colts front and center in the NFL news cycle.

After a roller-coaster ride consisting of questionable public comments, permission to seek a trade and some reported offers, the dust has settled. Taylor won’t be ready to start the season due to an ankle injury, but he’s still on the Colts’ roster.

That might seem like a win—Indy didn’t accept an offer just for the sake of it and kept their star in town—it’s actually a gamble. Irsay could ultimately come out looking like the big loser.

Kevin Mazur/Getty; Cooper Neill/Getty

Keeping Taylor doesn’t solve everything

While it’s unclear when Taylor will be ready to return from the PUP (Physically Unable to Perform) List, the lack of a suitable trade offer suggests that he’ll remain with the Colts, at least for now. And while no one ever wants to see a star player leave town, keeping him could throw off Indianapolis’ balance between risk and reward.

So, what are the potential risks and rewards?

Starting with the latter category, Taylor obviously makes the Colts better. Even if he misses some time and needs a few games to reach his best, the running back is a legitimate game-changer. His presence will be especially important when you remember that the Colts have a rookie quarterback, Anthony Richardson. A strong ground game will take some weight off his shoulders.

It’s also possible that Taylor will like the team’s direction and pledge his long-term future to the Colts. That’s a two-part equation—he has to be offered an extension before signing—but it would be a positive in terms of sheer talent.

The risks, though, are a bit larger.

First, there’s no guarantee that Taylor will be a positive presence within the team. If this summer’s public trade saga is any indication, he isn’t exactly pleased with Irsay and the Colts’ brass. Having a potentially unhappy star within the camp isn’t ideal, especially when there’s a young quarterback trying to turn things around.

In a similar vein, no one knows how productive Taylor will be this season. Even if we assume that he’ll put the past behind him and return with a perfectly professional attitude, he’s coming off an injury-shortened 2022 campaign and sitting out the start of 2023 with an ankle issue. We don’t know when he’ll return and how effective he’ll be at that point.

Add that there’s no guarantee he won’t leave town in the future—the Colts can franchise tag him to keep him under contract but doesn’t address Taylor’s desire for a change of scenery and the possibility of an ugly holdout—and you come to the crux of the risk.

Trading Taylor, however unpalatable, would have represented some return for an uncertain asset. Keeping him on the roster, while positive in the short term, could be largely insignificant. With all due respect to the Colts, they’re not expected to win the Super Bowl this year. If Taylor plays eight games and leaves for free agency after Indy goes 6-11, would that be worth it? Or would you rather have a couple of draft picks in your back pocket?

Irsay could have damaged his reputation

NFL contracts are complex, multi-faceted things. There are large sums of money involved, and playing in certain markets or under specific coaches also can provide some extra appeal. And while ownership doesn’t usually factor into the equation, the big boss can set an overall organizational tone.

That’s where Irsay’s handling of the Taylor situation comes in.

On August 28, Ben Standing of The Athletic published an NFL agent survey. One of the questions focused on the Colts-Taylor situation, and several responses were critical of Irsay.

“This doesn’t look good for the owner [Jim Irsay] or the player,” one anonymous agent said. “The market talks, and it’s ghosting the running backs. I stopped recruiting them a while ago. There are special players, but one knee injury can ruin a career. But the owner isn’t winning over the locker room with his childish social media talk.”

“Jim Irsay,” another agent added. “He spoke out about the RB situation and Taylor getting bad advice from his agent—the agent then fired back and got the kid involved—and basically said we’re not paying him s***….It becomes difficult to work with that boss, especially if he’s not going to pay what you think you’re worth.”

Two others also specifically mentioned the Colts owner.

“Taylor does not have any leverage,” one agent said. “But the Colts’ owner should get out of the way and let his GM handle it.”

The fourth quote was even more pointed: “If [Irsay] had kept his thoughts to himself, Taylor likely stays and plays. Instead, Irsay ruined it and gave Taylor an easy reason to demand a trade. Why not take it since that franchise is not showing a ton of promise?”

While you could take issue with the sample size—The Athletic spoke to 23 agents and only four mentioned Irsay—the answers suggest that at least some are viewing the Colts owner through the lens of the Taylor saga.

Will that matter, especially in situations when Indianapolis is presenting the best offer? Maybe not, but tanking your reputation with agents is certainly a risk when you’re the head of a franchise. You want every advantage—not disadvantage—when you’re at the bargaining table.

It’s quite possible that the ramifications of this offseason won’t be fully seen for years. In that vein, don’t assume that there’s a happy ending to the Taylor situation just because a trade failed to materialize.